While carbon markets have long been hailed as a mechanism that can close the conservation finance gap, the Guardian’s article at the beginning of 2023 threw the efficacy of this mechanism into question, largely on the basis of West et al.’s highly critical study of REDD+ projects.

The Guardian’s claim relates to REDD+ projects, previously the largest project type represented in the voluntary carbon market, which issue credits by protecting trees that would otherwise have been deforested.

This new study, led by Prof. Ed Mitchard (Chief Scientist, Space Intelligence), claims that there were “serious errors” in the original publication cited by the Guardian, stemming from a combination of “numerical errors” and “completely inappropriate” control areas used to establish what would have happened to the protected forest in the absence of a carbon project.

For CFP Energy, there are two big takeaways...

There are high-quality projects out there. Mitchard et al.’s new study suggests that the combined errors “likely decreased the observed estimated impact” of the REDD+ projects analysed by West et al.

As a result, a much higher proportion of REDD+ projects should be considered effective compared to the Guardian’s estimate of 6%.

This echoes the views of Sylvera and Renoster, two leading carbon credit ratings agencies, whose own figures suggest that 25-30% of projects should be considered high-quality.

Proper due diligence pays big dividends. While 30% is a lot bigger than 6%, it’s also much less than 100%.

There are still several projects on the market that are not delivering on their stated climate impact, which means that companies that take the time to sort the wheat from the chaff have an outsized positive impact relative to their peers.

Ultimately, the main takeaway is something that industry insiders have known for a long time –Verra’s old REDD+ methodology was too vulnerable to being gamed by bad actors, but at the same time there are projects out there which have genuinely delivered on halting deforestation (sometimes disproportionately well compared to how many credits they’ve issued).

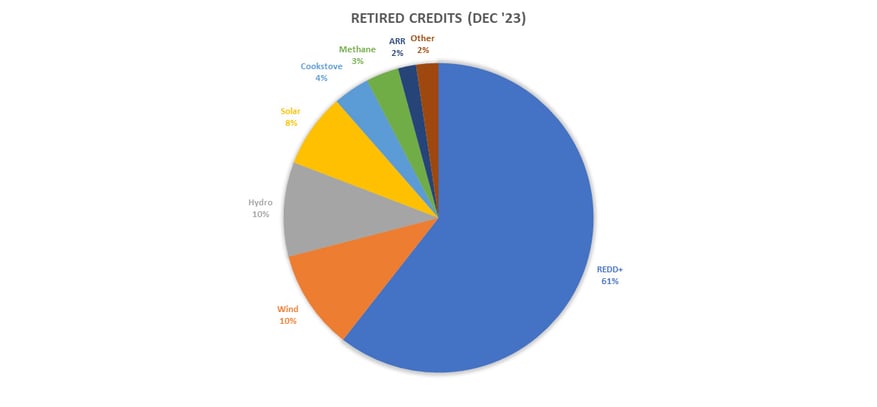

The fundamental case for REDD+ projects remains too strong to ignore – it is more cost-effective to protect trees than to re-plant them. Market participants seem to have remembered this fact, with REDD+ credits making up the majority of all credit retirements in December so far, as seen above.

Hopefully this new study, in combination with the release of Verra’s updated REDD+ methodology, will mark the beginning of the REDD+ market delivering on the promise of channelling finance to the world’s forests at the scale required to keep the 1.5 degrees pathway alive.

The voluntary carbon market is a rapidly developing and vital instrument to drive finance into nature-based projects that can achieve major results, but like many commodity-based market places confidence is critical for its success.

Here's our team providing details on the next stage of the voluntary carbon market.