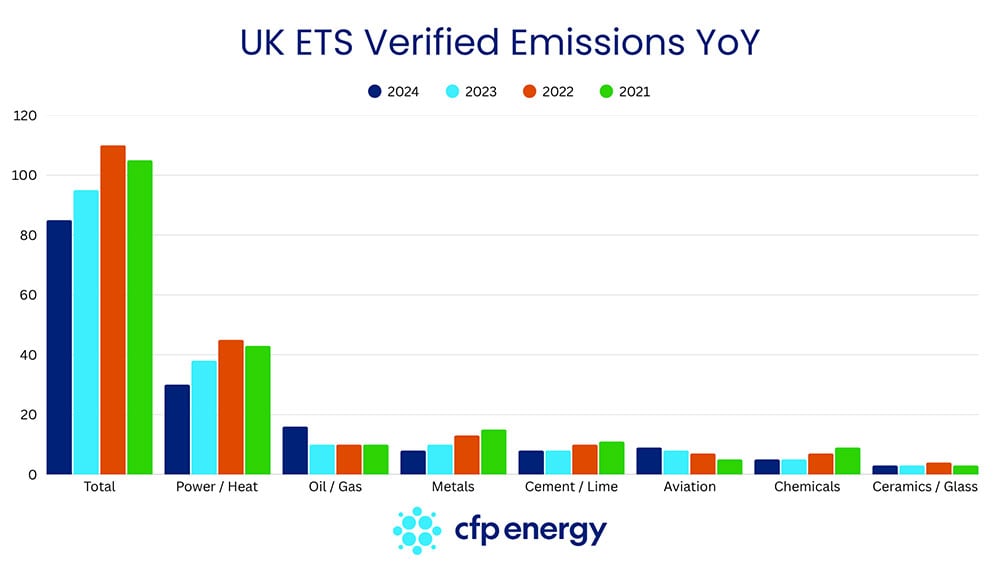

On Wednesday 12th June, the UK government released the UK ETS verified emissions data for the 2024 compliance year. At 85.6 million tonnes CO2e (tCO2e), total covered emissions fell by 11.5% year-on-year, continuing a downward trend that began in 2022, after delayed demand destruction in response to the 2020 and 2021 pandemic years.

While this 11.6m tCO2e drop in emissions is largely due to continued growth in renewables, it also reflects a wider macroeconomic sentiment with reduced industrial output and well-publicised site closures in the steel, fertilisers and chemicals sectors.

Power and Heat

As in previous years, the largest contributor to the decline was the power and heat sector, with emissions falling by 18%, following a 23% drop YoY for 2023 emissions. This is a result of continued growth in renewables, increased net imports, and the final phase-out of UK coal-fired plants.

Industry

Industrial emissions last year also posted a decrease of 4.5 Mt (-8.1%) (see figure below). This was largely due to installation closures, most notably the winding down of operations at Port Talbot Steel Works and the continued economic challenges faced by UK manufacturers.

The metals sector, meanwhile, registered a -26.9% change in emissions - down to 7.5Mt from 10.3Mt. Significant changes in emissions were also recorded for the Ceramics & Glass and Chemicals sector, with emissions decreasing by -7.5% to 1.4Mt CO2 and -4.6% to 3.3 Mt CO2 respectively.

Aviation Sector

The Aviation sector forms an outlier - emissions from the Aviation activities edged up again in 2024 by 2.1% to 9Mt CO2, following a global trend of post-COVID recovery in air traffic reflective of revived readiness to travel abroad.

Market view

The emissions data for 2024 was broadly in line with the forecasts from market analysts. As a result, there was no material impact on expected supply-demand balances in the short term, especially when the topic of a link to the EU ETS continues to dominate the market rhetoric.

That said, long-term supply tightening remains the dominant narrative in both UK and EU ETS. The phased removal of free allocations, introduction of the CBAM, rebasing of the cap, and potential market design changes via a Supply Adjustment Mechanism (SAM) will keep market balances in focus as we head toward 2030.

Looking Ahead

With CBAM implementation in sight, renewed commitment to “work toward” a link with the EU ETS, upcoming consultation responses, and ambitious decarbonisation targets, the UK ETS is approaching a critical reform phase. The 2024 data reinforces the falling trend for UK ETS emissions. However, questions remain about the continued pace of renewables growth, as well as the ability for industry to achieve decarbonisation in the short term, given the overlapping risks of deindustrialisation, trade tariffs, and security of supply issues.

To discuss how these trends affect your UK ETS exposure or to receive a tailored market briefing, please get in touch with our team.