-

89% of Europe’s manufacturers participate in the UK/EU Emissions Trading Scheme (ETS), with 88% expecting increased demand for carbon allowances shortly. Of these, 92% have already budgeted for higher costs.

Our recent report - Decarbonising the Future - surveyed over 500 large-scale manufacturing firms across the UK, Germany, and France.

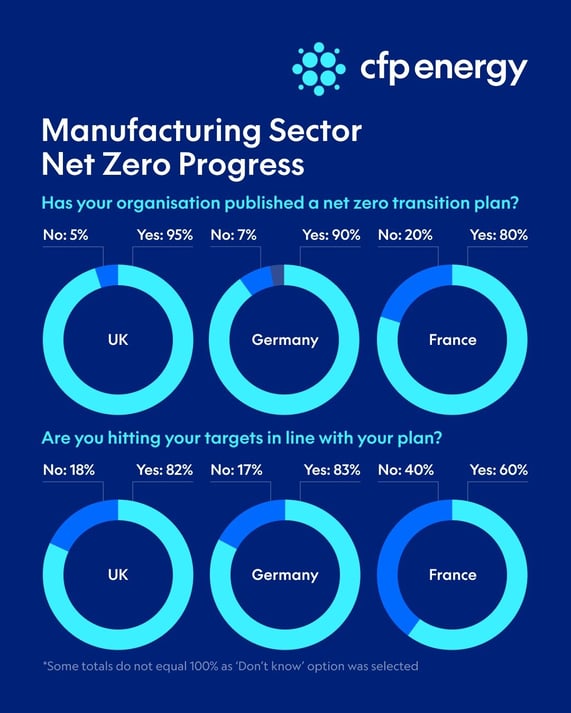

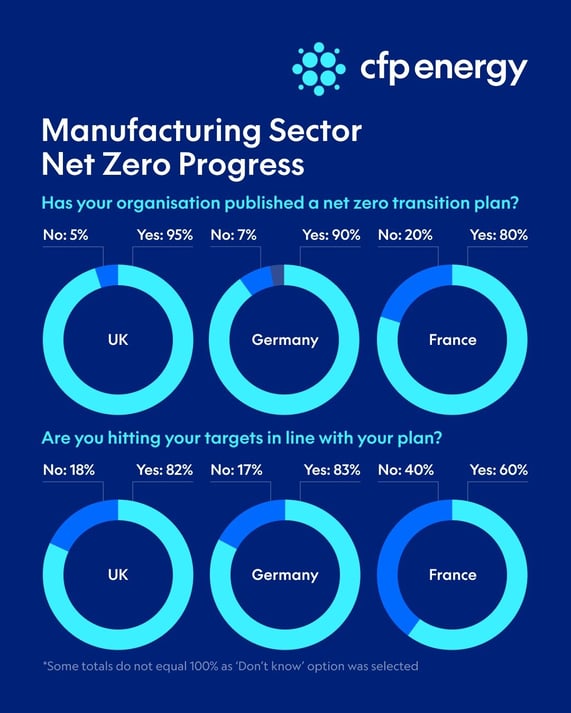

Findings indicate that while the majority of manufacturers have started planning for Net Zero, gaps in carbon compliance strategies and varying levels of preparedness across Europe continue to threaten progress, with 19% expecting not to meet their decarbonisation targets.

A comparative look at UK, German, and French decarbonisation readiness

The report shows differing levels of engagement and readiness among manufacturers across Europe’s three largest economies. The survey identifies technology availability as the most critical barrier to progress, affecting 75% of all manufacturing respondents.

UK manufacturers lead ETS, but face technology and knowledge gaps

UK manufacturers lead in terms of participation in the ETS market, with 91% currently buying allowances and 93% budgeting for higher future carbon costs. 90% of UK respondents have already adopted compliance strategies, such as futures contracts to manage rising carbon costs, and 95% have already published Net Zero plans.

However, the lack of available technology remains their top barrier, with 82% of UK manufacturers reporting technology challenges potentially holding back longer-term decarbonisation efforts, followed by knowledge (74%) and funding challenges (63%). Regulation barriers are noted by 55% of respondents, highlighting a need for more consistent and accessible compliance support.

German manufacturers adopt compliance strategies but slow to adapt to carbon prices

German manufacturers also demonstrate strong involvement in compliance strategies, with 92% of respondents adopting methods like futures contracts to mitigate risks associated with carbon price increases.

However, only 79% foresee a rise in carbon allowances demand, suggesting a potentially slower pace of adaptation to regulatory changes compared to the UK. German manufacturers report relatively fewer challenges around technology availability (52%), indicating a more supportive landscape for innovation and knowledge resources than other regions.

French manufacturers lag in ETS, facing tech and funding challenges

French manufacturers show a different profile, with 80% of respondents involved in ETS purchases — the lowest among the three countries.

Access to technology is a significant hurdle, with only 20% of French manufacturers citing sufficient technological availability. Furthermore, over half of French respondents (60%) face funding gaps and knowledge barriers, revealing the need for enhanced resources to facilitate compliance and technology adoption.

Tim Atkinson, Director at CFP Energy, commented on the survey’s results

“It’s encouraging to see many of the survey participants are planning for rises in future ETS carbon prices and taking advantage of the flexibility carbon markets offer to manage rising compliance costs, whilst technology challenges are addressed. It has never been more important for businesses to ensure they are prepared for the paradigm shift of tougher targets and higher carbon prices that are set to impact both the UK and EU Emissions Trading Schemes over the next 5-10 years.

In the survey results, and within our own client base, we see a strong uptake of PPAs, Green Certificates, Voluntary Carbon Credits and biofuels across Europe, which is an encouraging sign but there are still significant gaps in knowledge across the industries that we have surveyed.

What is most interesting is the barriers that industry stakeholders attribute to holding their respective sectors back. Between funding issues, regulations, knowledge gaps and a lack of technology, large-scale organisations face a mountain of issues to overcome. We hope this report provides business leaders with actionable solutions to tackle decarbonisation amidst volatile conditions. The solutions to decarbonise exist, we simply need to provide better access to them.”