- Insights Centre

- Insights

Mounting Maritime Risk...Geopolitics, carbon rules & investment uncertainty

.png?width=1920&name=CE%20Events%20(16).png)

The shipping industry moves four-fifths of all global trade and is responsible for around 3% of global greenhouse gas emissions (GHG), which must be reduced by 50% by 2050 under the Paris Agreement.

But such a task is looking increasingly difficult as a convergence of risks are threatening to destabilise the global industry at a scale rarely seen before.

The tourching of the International Maritime Organisations's critical global emissions regulations, by the US, laid waste to years of careful planning, unilateral agreements and industry buy-in.

While the IMO has advanced a fuel-intensity framework and technical efficiency standards, it failed to secure agreement on a binding global carbon pricing mechanism, leaving shipowners exposed to fragmented regional regulation rather than a single worldwide carbon cost.

Cyber treats are mounting and hundreds of millions have already been lost to international crime groups and state-sponsored attacks, targeting critical infrastructure around the world.

The emissions trading scheme, operating across the EU and UK, now covers 100% of shipping emissions, adding another layer of risk and complexity for compliance and financial planners.

While investments in the next generation of sustainable vessels stalls, the development and mass adoption of green fuels has also failed to achieve the level of adoption many had hoped.

Throw in the impact of two black swan events in the past six years, the growing influence of the 'dark fleet' and rapidly developing geopolitical issues, it's hard to know what the future looks like for this critical pillar of the global economy and its battle to decarbonise.

This article will analyse these risks in more depth, with key insights from Tim Atkinson, Head of Carbon at CFP Energy.

You can listen to the full article by clicking the 'play' icon to the right of this text, or click on the headlines below to skip to a specific section.

- The carbon compliance crunch

- Black swans rock the boat

- The shipyard's stalemate

- Cyber security's rising tide

- The dark fleet and data gap

- On the horizon

For immediate support with ETS regulations, you can secure allowances and ensure compliance with the support of an award-winning team, here.

More risk, less progress

A recent study in Nature Communications Earth & Environment puts numbers to what many industry insiders already know, geopolitical instability is quietly sinking decarbonisation momentum.

Researchers found that rising political risk, from sanctions to armed conflict, can slash national willingness to cut maritime emissions by more than 14 %, and that sustained instability could delay the International Maritime Organization’s (IMO) 2050 net-zero target by half a century.

This target took a significant blow as the global emissions regulation was sunk by the US after weeks of pressure on the IMO.

"That means the effort to set binding international rules to cut greenhouse gases from shipping, responsible for about 3 percent of global emissions, goes into the deep freeze for a year. During that time, the U.S. and other opponents can try to rally more support to kill it completely. " Politico

The impact of this pushback is detrimental on a global scale. It limits international consensus, fragments regulation and clearly demonstrates, when politics splinters, climate progress slows.

As long as powerful economies hesitate, global shipping remains stuck between ambition and inertia.

However, the failure of the IMO to pass legislation doesn't mean the end of decarbonisation for the shipping sector.

The landmark carbon compliance regulation, the emissions trading scheme (ETS) has been in operation since 2005 and has been growing incrementally ever since.

EU ETS (Shipping – from 2026)

Shipping entered the EU Emissions Trading System in 2024 under a phased-in regime, with full allowance surrender obligations applying from 2026 and methane and nitrous oxide emissions also brought into scope.

- Commercial ships ≥ 5,000 gross tonnage (GT)

- Covers voyages between EU/EEA ports (100% of emissions)

- Covers voyages between an EU/EEA port and a non-EU port (50% of emissions)

- Covers emissions while at berth in EU ports

- Applies to CO₂, methane (CH₄) and nitrous oxide (N₂O)

- Includes container ships, tankers, bulk carriers, cruise ships and large general cargo vessels

- Excludes most smaller ships (< 5,000 GT) and non-commercial government vessels

UK ETS (Shipping – from mid-2026)

The UK ETS will apply carbon pricing to large ships operating on domestic UK voyages and in UK ports.- Commercial ships ≥ 5,000 gross tonnage (GT)

- Covers domestic UK maritime voyages (UK port to UK port)

- Covers emissions while at berth in UK ports

- Initially focused on CO₂ (with scope to expand later)

- Excludes military, coastguard and other government vessels

- International voyage coverage is under consultation and may be phased in later

The success of the ETS proves that tough regulation can be enforced and if the maritime sector learns how to hedge and manage carbon risk as well as does for bunker fuels, major changes could be achieved.

The carbon compliance crunch

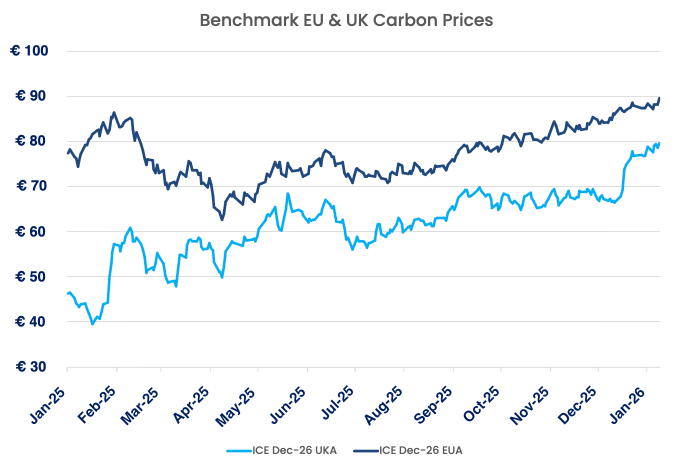

The price of carbon allowances is only going to increase due to increased demand and the inclusion of more operators across every industry, as well as trader activity.

Tim Atkinson, Head of Carbon for CFP Energy, said:

"Increased government ambition, tighter regulations, greater corporate sustainability commitments, and the outcome of the international COP process will demand serious net zero action from large-scale organisations over the next decade and beyond.

In the years leading up to 2050, when the EU, the UK and many others are looking to achieve net zero, new environmental regulations, growth in renewables and reform of flagship emissions trading schemes will have a greater impact on businesses than ever before.

And this change is significantly closer than many think.

For companies covered by the EU Emissions Trading Scheme (ETS) and UK ETS, a paradigm shift is on the horizon."

Unlike the failed IMO regulation, the ETS was rubber stamped all the way back in 2005, growing in impact and scale ever since.

The shipping sector was only encompassed in 2024, with 40% of emissions covered.

But now, a mere two years later, 100% of shipping emissions are covered by the emissions trading scheme.

Within the shipping industry, there is genuine appetite to drive decarbonisation and provide a clear roadmap for ship builders, ship buyers, fuel suppliers and traders.

Confidence should not be lost, despite the failure of the IMO regulation, in the long term impact of emissions policy as demonstrated by the success of the ETS.

However, that does not mean that key challenges are ahead for those covered by the scheme...

The maritime sector is being exposed to the ETS at a time of high price volatility and complex contractual risk.

Atkinson commented (14 Jan) :

"Bullish sentiment remains firmly in control of carbon markets, as six consecutive days of gains see EUAs surpass €90 (a 30-month high) and UKAs climb over £70 (a 33-month high).

Trader confidence in the "bull" case for EUAs showed no signs of abating as more funds entered the market and added a massive 10.6m in NEW long positions. UK carbon, meanwhile, is again pushed higher by news reports that the "EU, UK to start carbon market negotiations next week".

All this is further supported by rising TTF gas prices and a forecast of colder weather. The question everyone is asking is how much more appetite do funds have to push EUAs to €100."

EUA prices have tripled since 2021, peaking above €100 per tonne in 2023, while UK Allowances (UKAs) trade with lower liquidity and wider spreads.

Each shipowner must now decide who is responsible for compliance: the owner, operator or charterer.

And those who fail to surrender allowances face fines of €100 per tonne of CO₂ output, plus potential bans from EU ports.

The complexity of defining contractual responsibility across time-charters and joint ventures creates genuine financial exposure.

The key insight isn’t simply that carbon costs are rising, it’s that compliance has become an operational variable as fundamental as fuel or freight rates.

Whether the shipping sector at large, is prepared for this new paradigm, is another question entirely.

To get further insight on the carbon compliance crunch, access our industry-report, here.

Meeting the ETS compliance challenge

By taking a serious approach to your carbon compliance strategy, and investing in allowances at the right time, your organisation could save millions.

Creating a carefully planned carbon compliance strategy that mitigates risk and ensures long-term security at the lowest cost possible.

Instead of being reactive to compliance deadlines and buying when you only have a few days to execute the purchase, plan ahead and secure significantly lower prices months ahead.

As ETS2 and new regulations come into view, an increasing spectrum of industries will be impacted by carbon taxes.

Analyst forecasting show allowance costs trending upwards through 2030 as industrial free allocations are phased out, ETS caps tighten and demand increases.

.png?width=1554&height=1117&name=CE%20Events%20(20).png)

For shipping companies, learning to manage that exposure, purchasing allowances strategically, integrating cost-pass-through clauses, or hedging future EUA/UKA prices, will determine profitability as much as fuel efficiency ever did.

This is nuance often missing from mainstream coverage of the carbon market in particular.

It shouldn't be treated as a burden left to the last minute, it’s a fundamental tool for navigating the energy transition itself and potentially getting a competitive edge over competitors paying less attention to carbon markets.

To get ahead of the carbon compliance waves heading your way, get in touch with our team, here.

Black swans rock the boat

Few sectors reflect global disorder as vividly as shipping.

COVID-19 revealed how a novel virus could bring ports, containers and worldwide supply chains to their knees.

Then came the Russia–Ukraine war, which redrew trade maps, rerouted tankers and sent fuel bills soaring. The impact of the conflict continues to disrupt the entire sector.

According to The United Nations Conference on Trade and Development (UNCTAD), average voyage distances have grown from 4,800 nautical miles in 2018 to over 5,200 by 2024, as ships sail longer detours to avoid conflict and sanctions, a shift that alone adds around 2–3 % to global maritime CO₂ emissions each year.

The Red Sea crisis has also highlighted that regional instability can ripple through the global economy.

A full explainer of the impact on the shipping sector, can be found here.

IMF data show traffic through the Suez Canal dropped by half in early 2024, while voyages around the Cape of Good Hope surged 70%.

Each extra day at sea adds both cost and carbon.

A Cape detour for a typical container ship burns roughly 800 additional tonnes of fuel and emits nearly 2,500 tonnes of CO₂.

Multiply that by thousands of voyages, and a single chokepoint crisis can erase months of decarbonisation gains.

Once more, it's a clear reflection of the almost impossible task the shipping sector faces when attempting to decarbonise at scale.

The shipyard's stalemate

These pressures are converging most visibly in the shipbuilding market, where geopolitical risk, fuel uncertainty and regulatory divergence are now directly shaping fleet renewal timelines.

Investing and launching a state-of-the art vessel represents a 25-year bet on fuel technology that barely exists today, however, that hasn't stopped some operators preparing.

Orders for methanol and ammonia-ready ships are growing and Maersk alone has more than 20 on order. While large global carriers are pushing ahead with next-generation fleets and alternative fuel strategies, smaller and mid-sized operators are increasingly delaying decisions due to regulatory ambiguity, fuel availability risk and capital cost uncertainty.

Furthermore, the supporting bunkering network lags far behind and just as investments are required to modernise national grids, it's critical that renewable fuel infrastructure is developed to support the fuelling requirements of the ships of the future.

Axel Vanmeulder, a biofuels expert from CFP Energy, notes:

“Blending is the practical bridge. We’re seeing examples of B30, where 30% of a ship’s fuel is bio-based with molecules like FAME (Fatty Acid Methyl Esters), becoming viable in today’s engines. It’s not a silver bullet, but it’s a significant step away from pure fossil fuels.

Across most major newbuild segments, shipowners are now ordering dual-fuel engines as the default specification, although uptake varies materially between container, tanker and bulker fleets.

The ability to switch between LNG and conventional VLSFO, and increasingly bio-blended fuels, gives operators much-needed flexibility in an environment where fuel availability, pricing and regulation are all in flux.

Dual-fuel capability is in todays market the best way to be cost-competitive, future-proof and have optionality.

It allows owners to proof for future regulations while remaining cost-competitive.”

Cyber security's rising tide

.png?width=2048&height=1152&name=CE%20Events%20(17).png)

Beyond the visible challenges on the high seas, a quieter threat is rising below the surface, cyber insecurity.

As shipping rapidly digitalises, from autonomous navigation systems to electronic bills of lading, it has become an increasingly attractive target for cyberattacks.

In today’s world, keeping trade routes “safe” no longer just means guarding against pirates or missiles...it also means defending against malware, ransomware and data breaches.

The maritime sector has historically lagged behind other critical industries in cyber defence, but incidents are accelerating fast.

In 2023 alone, researchers recorded at least 64 cyberattacks across shipowners, ports and marine suppliers, with many more likely going unreported.

Rafael Narezzi, Founder of Cyber Security firm Cyber Energia, said:

“As in the energy sector, shipping is becoming increasingly dependent on digitally interconnected systems, a trend that significantly expands the cyber threat landscape.

This reduces the effort required for compromise and heightens the risk that cyber incidents have direct impacts on vessel operations and safety.”

These ranged from ransomware crippling port terminals to breaches of ship management software.

One of the most disruptive incidents came in January 2023, when a ransomware attack on DNV’s ShipManager platform forced systems offline and disrupted operations on around 1,000 vessels worldwide.

The Port of Lisbon was similarly hit by a LockBit ransomware attack in late 2022, halting operations for four days and triggering a $1.5m ransom demand.

The lesson is clear. Vulnerability extends across the entire maritime ecosystem.

What makes the current moment more dangerous is the emergence of AI-driven cyber threats.

The UK’s National Cyber Security Centre has warned that artificial intelligence will significantly accelerate cyber intrusions, allowing attackers to penetrate systems and extract data at unprecedented speed.

Officials speaking at CyberUK 2025 highlighted four major risks to sectors like shipping.

- Faster AI-enabled attacks.

- A widening gap between organisations with strong defences and those without.

- Growing exposure from aging digital infrastructure.

- The prospect of weaponised AI capable of disrupting navigation or port operations.

In short, an under-protected industry is colliding with increasingly sophisticated tools.

Modern ships and ports are now data-dense environments. Vessel telemetry, cargo data, port schedules and supply-chain records have become strategic assets.

A well-timed cyberattack can shut down terminals, delay cargo flows or even compromise vessel safety. The NotPetya attack on Maersk in 2017, which cost the company an estimated $300m, remains a warning of how quickly digital incidents can escalate into global trade disruption.

Yet many shipowners still report limited cybersecurity training and underinvestment in IT systems, even as always-connected vessels and onboard IoT devices expand the attack surface.

The consequences of a major cyber incident could be severe.

Legal experts have warned that a successful attack on a vessel or major port could trigger disruption comparable to large-scale infrastructure failures, with knock-on effects across global supply chains.

NATO has also flagged maritime cyber threats as a strategic concern, given that ports handle around 80% of global trade and play a critical role in military logistics.

Cybersecurity has therefore become a material destabilising factor for the shipping sector, capable of compounding geopolitical, regulatory and operational risks.

Addressing it requires elevating cyber resilience from a technical issue to a board-level priority. Regulators and industry leaders are increasingly calling for stronger standards, intelligence-sharing and advanced encryption, alongside the IMO’s existing cyber risk guidelines.

As shipping invests in cleaner fuels and new technologies, it must also invest in digital resilience. In an era of mounting global instability, keeping supply chains moving means securing them, digitally as well as physically.

The dark fleet and data gap

.png?width=2048&height=1152&name=CE%20Events%20(16).png)

Compounding these challenges is the shadowy rise of the “dark fleet” untracked tankers carrying sanctioned oil between Russia, Iran and previously, Venezuela...

The Atlantic Council estimates they now represent 17 % of global tanker tonnage. These ships operate in opacity: they often obscure their AIS tracking signals, use deceptive ownership structures, and avoid reputable insurers and classification societies.

The goal is to evade sanctions and monitoring, but the proliferation of untracked voyages means a growing blind spot in global data.

For legitimate operators under ETS scrutiny, the contrast is stark.

Compliance costs rise, while rogue actors sail tax-free...

For regulators trying to curb emissions, the dark fleet poses a serious problem.

Legitimate shipping companies are spending money to comply with ETS monitoring, emissions reporting, and efficiency rules, while rogue operators run “tax free” and off-book.

This undermines the integrity of emissions data. If a significant slice of global shipping emissions isn’t being measured or reported, it skews the baseline and makes it harder to enforce global reductions.

It’s a regulatory asymmetry that frustrates honest players and rewards bad actors. For example, a compliant tanker company might pay for cleaner fuel or carbon credits, whereas a sanctions-busting tanker sailing without any scrutiny pays nothing (aside from the risk of getting caught, which historically has been low).

This dynamic can also distort freight markets.

Unscrupulous operators can offer lower rates because they cut corners on safety, maintenance, and compliance (effectively a form of carbon leakage), creating competitive distortion.

And if global volatility increases further and more conflicts concerning energy sources develop, more and more ships may "go dark" to avoid sanctions and higher carbon taxes.

Once more, without total unilateral action, this is not a problem that will go away.

On the horizon...

.png?width=2048&height=1152&name=CE%20Events%20(18).png)

The thread running through all these issues, from cybersecurity warnings to the dark fleet alarm, is that shipping’s long term decarbonisation, growth and development is not just a technical challenge.

It’s about alignment.

Political alignment, regulatory alignment and financial alignment.

Technology is progressing (prototypes of green ammonia engines & wind-assisted vessels exist and digital efficiency tools are growing) but the speed of adoption will depend on how well global actors row in the same direction.

Mechanisms like the EU ETS are landmark steps, internalising carbon costs and nudging behaviour. reword

However, they must be matched by reinvestment.

There’s a strong case for recycling a portion of ETS revenues back into maritime innovation and infrastructure, rather than letting it all vanish into general budgets.

The industry needs help to build a robust alternative-fuel bunkering network, to retrofit ships, and to fund R&D for zero-emission vessels.

For analysts tracking the sector, the interplay between carbon prices, geopolitical risk, and route disruptions is creating a new calculus.

We’re essentially witnessing the emergence of a carbon-geopolitical feedback loop, wars and crises make voyages longer and more carbon-intensive; higher carbon intensity in turn raises costs under schemes like the ETS; those costs then influence trade patterns and even political sentiment.

Shipping companies now must model and hedge both physical risks (like chokepoint closures) and carbon market risks.

Those that can integrate these considerations, with the help of carbon experts such as CFP Energy, will be better positioned to turn volatility into opportunity.

In the face of turbulence, the winners will be those who innovate and adapt.

For shipowners and charterers, the priority is no longer whether carbon pricing will reshape maritime economics, but how quickly a structured compliance and procurement strategy is put in place.

This includes modelling EU and UK ETS exposure, securing allowance procurement pathways, integrating biofuel and LNG blending strategies, and hedging forward carbon and fuel risk to stabilise operating costs.

The vision of a net-zero shipping industry by 2050 is still alive, but the voyage will be far from smooth sailing...It will require unprecedented cooperation across nations and between public and private sectors.

For immediate support from our award-winning carbon compliance team, get in touch here.

About the author: George Brown

George Brown is a researcher covering the energy and environmental industries, focusing on carbon regulations and the cutting-edge solutions being developed to decarbonise the aviation, shipping, manufacturing, construction and transport industries.