The CBAM reporting phase is almost over...

Under the EU's CBAM policy framework, the final quarterly CBAM report must be submitted by December 31, 2025.

After this date, importers must purchase and surrender CBAM certificates to cover their reported emissions and deduct any carbon price paid in the country of origin (where applicable).

If you're importing aluminium, cement, fertilisers, or any of the other covered goods, 2026 is the deadline to keep in mind.

From this date, you'll start paying additional CBAM costs for the products you import into the EU.

In practice, CBAM will introduce a range of administrative burdens and increased costs.

This is where CFP Energy comes in.

We're expert advisors in carbon markets, helping businesses navigate the complexities of the Carbon Border Adjustment Mechanism and develop robust compliance strategies.

To see how we can help you manage your exposure and access CBAM certificates before the deadline, contact our carbon team today.

Why CBAM Certificates are the Key to the Payment Phase

The transitional period, where importers only had to report emissions data, ends on 31 December 2025, according to UK government guidance.

From 1 January 2026 onwards, CBAM enters its definitive phase.

During this phase, importers will have to pay for the embedded emissions of their goods using CBAM certificates, where one certificate equals one tonne of imported CO₂e.

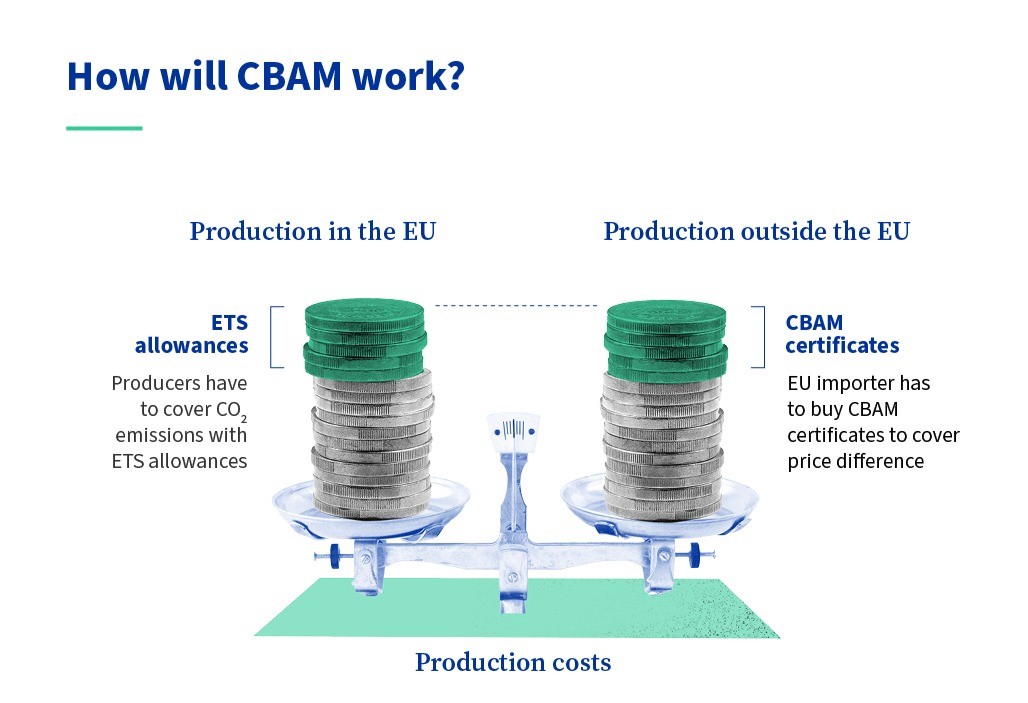

CBAM certificates will mimic the ETS's weekly average auction price, creating a level playing field between suppliers inside and outside of the EU. So that emissions aren’t double-charged, CBAM takes into account carbon taxes and ETS mechanisms (e.g., the UK ETS) outside the EU.

For example, if an importer can show a carbon price has already been paid in the product’s country of origin, the corresponding amount will be deducted from their carbon liability. In summary, EU importers will have to:

- Identify the imported goods that fall under CBAM.

- Select the calculation methodology and emissions factors to calculate the emissions.

- Declare the quantity of material.

- Declare the direct and indirect emissions embedded in imports.

- Assess if goods are already carbon priced in the country of production or purchase. If so, report the carbon price that is due or has been paid for the embedded emissions in the country of origin.

- Purchase the corresponding number of certificates.

Because CBAM certificates are tied to the EU ETS auction price, the price of CBAM certificates can fluctuate considerably.

Budgeting can become unpredictable, especially for high-volume importers.

.jpg?width=720&height=321&name=compressed_100kb%20(1).jpg)

Navigating the Hurdles of CBAM Certificate Procurement and Surrender

Once you’ve purchased CBAM certificates, these will have to be surrendered.

This means that any certificates procured will have to be submitted - or surrendered - to the EU’s CBAM registry.

The certificates surrendered should correspond to the embedded emissions of the product imported, whether steel & iron, fertiliser, cement, hydrogen, or aluminium.

Any excess certificates, i.e., certificates that don’t correspond to actual emissions, can be sold back to the European Commission.

Price Volatility & Budgeting

CBAM certificate prices aren't fixed. They fluctuate with the EU carbon market, which means forecasting your costs and managing budgets is essential.

Procurement Process

CBAM certificates must be purchased from Member State authorities via a central EU platform. Only CBAM declarants are allowed access to the platform.

Strategic Timing

The timing of your purchases affects both cash flow and how much you'll pay overall. Poor timing can result in unnecessary exposure.

Portfolio Strategies

To balance CBAM costs with other carbon market exposures (e.g., EU ETS, UK ETS), portfolio strategies, such as price-locking, are crucial to avoid overpaying.

These aren't just minor administrative details. These are advanced approaches to navigate compliance and mitigate CBAM certificates prices or years to come.

CBAM Export Certificates UK: How a Smart Procurement Strategy Can Mitigate Costs

Buying CBAM certificates is an unavoidable cost for businesses importing CBAM-covered goods into the EU.

However, with the right approach, certificate procurement becomes a strategic activity where informed decisions give you a competitive edge.

Businesses that develop proactive procurement strategies - informed by carbon market analysis, managing risk by forecasting potential outcomes - will mitigate their costs.

But smart procurement goes beyond buying CBAM certificates: a fully joined-up CBAM strategy should seek to reduce the number of certificates required in the first place. This means:

Encouraging decarbonisation

Push existing suppliers to decarbonise their production by setting clear emissions reduction targets, offering longer-term contracts as incentives for investment in cleaner technologies.

Investing in new supplier partnerships

Develop relationships with new suppliers who’ve already invested in low-carbon production, rewarding those who can demonstrate credible, long-term decarbonisation strategies.

Leveraging product investment

Work with suppliers to redesign products to reduce their carbon footprint. Design changes not only reduce CBAM certificate costs but can also deliver additional benefits, such as lower shipping expenses.

Every tonne of CO₂e you eliminate from your imports is a certificate you don't have to buy. Therefore, decarbonising your procurement gives you a tangible cost advantage.

Navigate Carbon Markets with CFP Energy

CFP Energy specialises in carbon markets. From the EU ETS to the UK ETS, we help businesses forecast potential costs, grasp the regulations currently affecting prices, and develop smart certificate procurement strategies that manage financial risk.

Going well beyond carbon compliance advice, we monitor carbon markets daily, tracking the policy shifts that allow us to make informed strategies on your behalf.

This enables us to help our clients navigate CBAM without guesswork. From establishing how many certificates you’ll need to estimating your budget exposure, we can help you meet the definitive phase of CBAM before the January 2026 deadline.

Contact our carbon team today to discuss your CBAM certificate strategy.